50+

Invested in 50+ startups through angel funds and Studio

2,500

Over 2,500 founders, mentors, and investors in our B2B tech network

1,000+

Empowered thousands of founders and startups through our accelerator, workshops, and events

90

Received an average of 90 NPS across our Space and Studio

About Venture Lane

We help startup founders and their teams impact the world by providing a curated community for our members, offering an impact-driven program, and supplying an impressive network of peers, mentors, and experts.

Never miss a thing! Subscribe to the Venture Lane Newsletter

The Studio

Welcome to The Venture Lane Studio.

We transform early stage B2B software companies with outstanding potential into growth stage ventures through a bespoke 12 week program and up to $100k investment.

Sales and GTM Focus

We firmly believe that traction is the #1 indicator for startup success.

Efficient Operating System

Set up the foundation for a scalable organization and team.

Fundraising

Pinpoint the best investors and fundraising strategy.

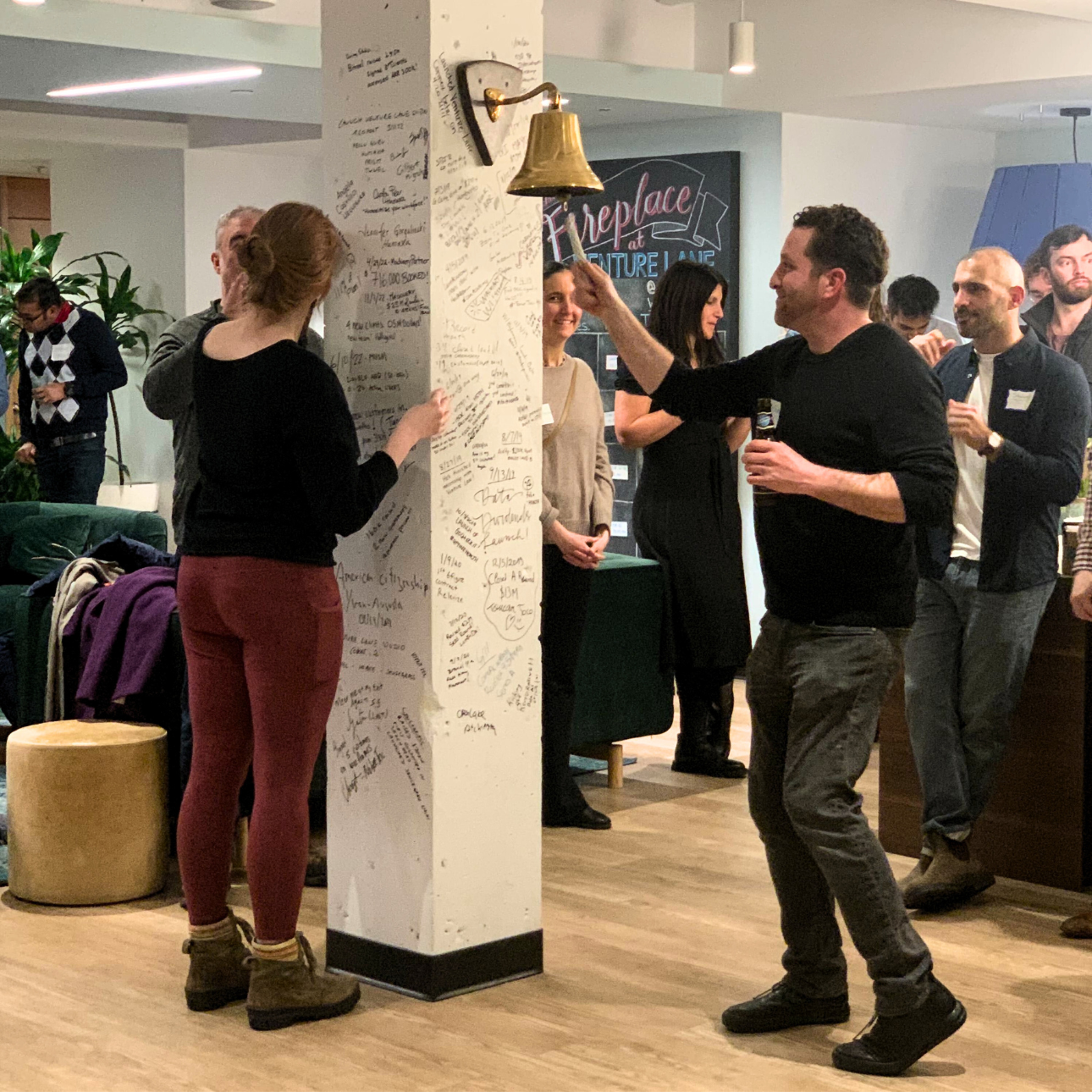

The Space

Welcome to The Venture Lane Space.

Venture Lane is a curated community and coworking space for Boston’s best B2B tech startup founders and their teams who want to mix with Boston’s network, get inspired, and be a part of an active community.

Boston’s premier B2B startup community

Tap into our network of founders, mentors, and investors to enhance your startup journey.

Unrestricted 24/7 access

Starting a business doesn’t adhere to a 9-5 schedule.

Short-term commitments

Embrace flexibility with no 12-month contracts.

Venture Lane Spotlights

Just a few founders' impacts and stories from members of our Space and Studio.

Join our Slack Community

Join over 2,000 members who are as awesome as you are!

A quick word from Christian, our founder

Join us on our mission to change the world, one startup at a time.

In my life as a startup entrepreneur, I realized the importance of a support system. Venture Lane is such a support system for B2B tech founders, their team and the entire startup ecosystem. We are passing down our experience to guide companies and founders to grow and prosper.

Resource Hub

Check out our resources from the Venture Lane team and trusted partners.

Programs

& Events

Connect with the Venture Lane community and the Boston tech ecosystem

At Venture Lane, we do our best to put together a robust event schedule each month in an effort to add value to our community and bring everyone together.